How College Savings and Custodial Accounts Are Treated in Divorce

October 15, 2013 | Child Support, Legal Perspective

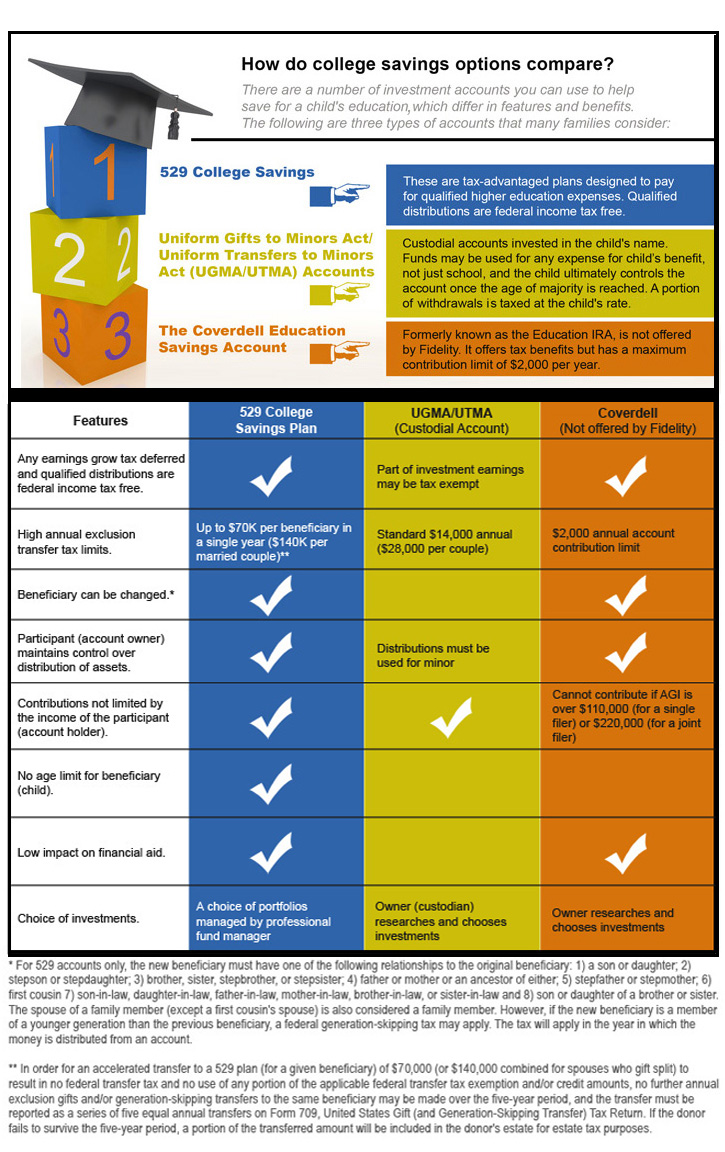

As a family lawyer, I have seen more and more families saving for their children’s futures in recent years. That’s a good sign. But when parents get divorced, what happens to the college savings can be unpredictable. There are at least four different vehicles for college savings: (a) Uniform Transfers to Minors Act (“UTMA”) custodial accounts; (b) 529 College Savings accounts; (c) Coverdell educational accounts; and (d) joint bank and investment accounts. Each has different characteristics, which are described in the graphic (thanks to Fidelity Investments) below.

What happens to college savings and custodial accounts in divorce might depend upon the form of the savings. Generally speaking, a divorce court has no jurisdiction over UTMA accounts. If there is a dispute over the management of UTMA custodial accounts, only the Orphans Court has the power to compel an accounting or change the guardian of the account. When a child turns 18, he or she may be eligible to sue the guardian for mismanagement. On the other hand, the divorce court does have power over 529 college savings accounts, which are legally the property of the parent owner. As such, 529 accounts can be treated as marital property and divided in equitable distribution, but most parents agree that they will be preserved for the benefit of the children. A Coverdell IRA, like a 529 plan, belongs to the parent and can be addressed in divorce proceedings. Like a 529, a Coverdell plan will probably be preserved for the children’s benefit. The least sophisticated college savings plan is a joint account in the names of the parent and child. In divorce, these accounts are usually treated like all other marital bank accounts and investments, and the intended purpose of the account is overlooked unless both parents insist. Notably, UTMA and joint savings accounts can diminish a child’s eligibility for financial aid, a consideration that parents and their lawyers should take into account when settling divorce proceedings.

Keep in mind that Pennsylvania law does not require divorced or separated parents to contribute to the children’s post-secondary educational expenses. There is a law on the books, but it was held unconstitutional years ago — because married parents have no legal duty to pay for their children’s college educations. Still, parents can agree to support their children’s college dreams by written settlement agreement. In fact, contributing to college savings and custodial accounts has become one of the most prevalent settlement techniques for divorcing parents who intend to pay for their children’s educations.